There are a number of car insurance apps out there nowadays to help make your insurance claims that bit easier and organising your cover faster. So, let’s take a look at the best –

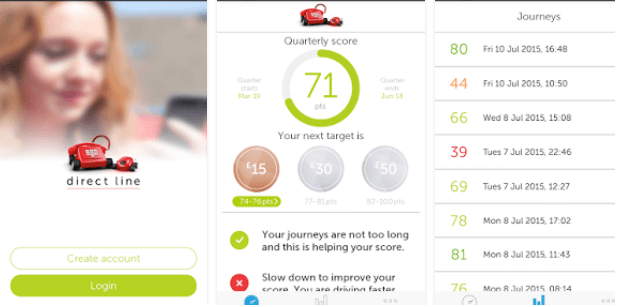

Direct Line

The DrivePlus app belongs to the telematics insurance policy offered by Direct Line. If you are a driver under 26 and you fit the DrivePlus plug-in into your vehicle, you benefit from a discount right off the bat. If you fall into the 21-15 years old age category, you qualify for a minimum discount of 15%. Furthermore, if you are under 21, you can get a 25% discount on your insurance premium.

The app provides you round the clock driving feedback, and you can use a trial version before you buy.

If you are too old for DrivePlus insurance, you can still install the app and use it. The moment you’ve passed the 200 miles limit, you’ll receive a code that should grant you up to 10% off your insurance premiums.

Nonetheless, you need to be aware that many users have mentioned in their reviews that this app lacks accuracy and is a battery hog.

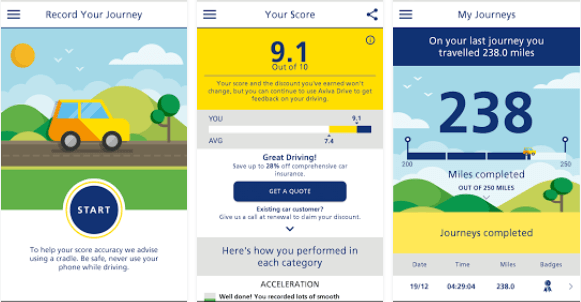

Aviva Drive

Aviva Drive offers you the opportunity to test your driving abilities while saving up to 20% of your car insurance. According to Aviva, if you are a safe driver, you can save over 100 pounds on average.

After you’ve passed the 200 miles milestone, you’ll be assigned an individual driving score between 0 and 10, where 10 is the safest. The app will provide you driving feedback and will calculate your discount, allowing you to unlock badges as you progress.

This app has scored better reviews than the Direct Line’s one. However, it crashes quite often and it drains your battery quite quickly. You could also try Money Expert for cheaper car insurance.

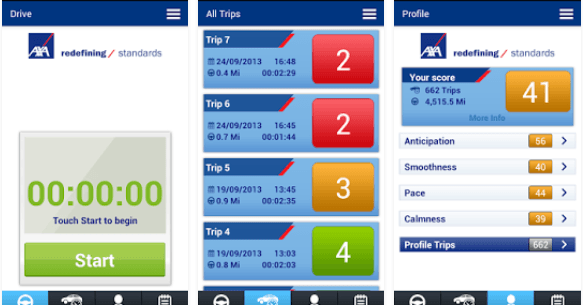

Axa

Axa has launched Drivology, an app that enables drivers save money on their car insurance premiums.

This app can check how often you use it to monitor your driving, how many miles you’ve driven with the app enabled, and the geographic location where it gets activated and deactivated. This enables Axa to check whether you keep your vehicle where you’ve told them.

Three months into using this app, your premiums are going to be recalculated based on your driving style. Another assessment will occur every three months after that. Beware, though, your prices may go up – almost 20% of Axa customers saw an average increase of about 50 pounds.

LV=

The LV= app is very similar to the one offered by Direct Line, both of them featuring the app itself, as well as a telematics box system. You’ll get your reward by using the app itself, and you could also save 15% on your car insurance cost.

You’ll have to drive for at least 200 miles over 10 or more journeys. The app will keep track of the number of miles driven, the time of the day when you use it, and the driving style.

This app has some troubles in identifying whether or not you’re actually driving. One of the Android app users said he didn’t find any record of his journey because the app through he was on a train.

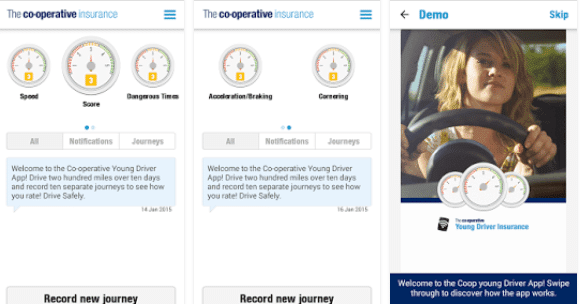

Co-operative

Co-operative offers a telematics app that targets exclusively young drivers (between 17 and 25 years of age). If you qualify, you could obtain a no claim discount on your insurance cost for each claim-free year.

Like all similar apps, Co-operative monitors the speed, the way you take corners, the braking habits and the time of day.

According to Co-op, over 80% of their drivers have managed to obtain a discount on their insurance premiums. Driver scores are important in this app, but can help people save.

These apps are all there to benefit people and if you’re looking to lower insurance, you should consider them.